Expiry Day Trading Strategy: A Complete Guide

Discover the Expiry Day Trading Strategy to maximize your profits. Learn effective techniques and tips for trading on expiration days with confidence.

Trending News Fox, Kolkata

Expiry Day Trading Strategy: A Complete Guide

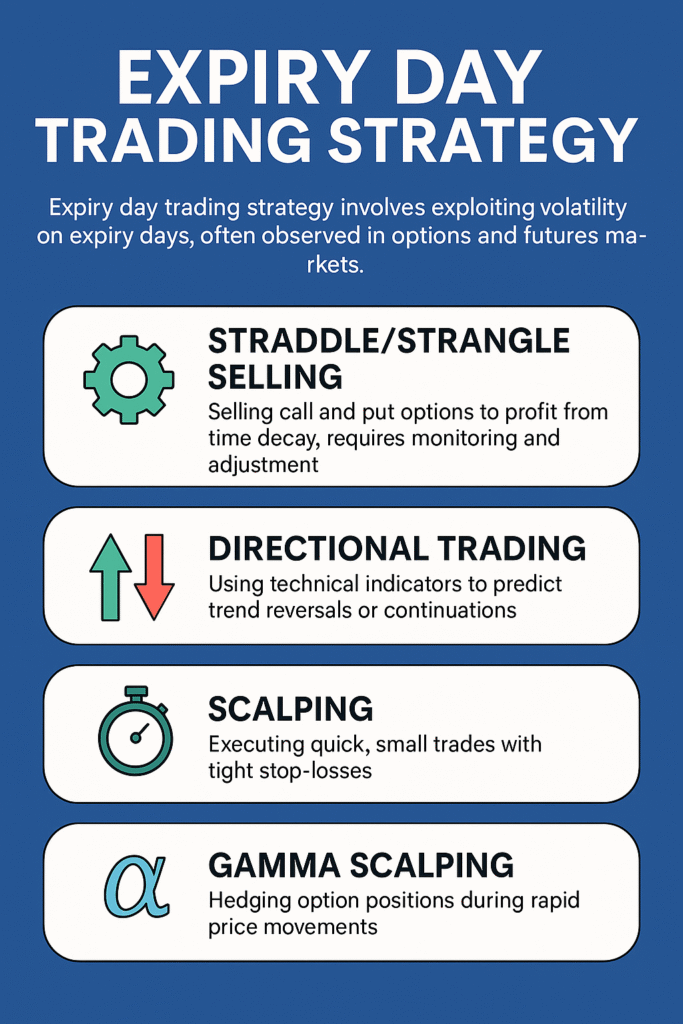

Expiry day, typically the last Thursday of every month in the Indian derivatives market, is known for high volatility and increased trading volume. It presents both risk and opportunity, making it a favorite for intraday traders. The expiry day trading strategy involves exploiting this volatility to earn profits by trading index and stock options or futures.

📈 What is Expiry Day?

In the stock market, especially in derivatives (F&O), expiry refers to the last day a contract (like Nifty or Bank Nifty options/futures) is valid. On expiry day:

- Open positions are settled.

- Traders either square off positions or roll them over to the next month.

- Option premiums can decay rapidly (time decay), benefiting sellers.

⚙️ Expiry Day Trading Strategy Explained

Here are some commonly used expiry day strategies:

1. Straddle/Strangle Selling (Premium Decay Strategy)

Traders sell both Call and Put options with the same strike price (straddle) or different strike prices (strangle) and profit from the theta decay.

- Works best when market is expected to remain range-bound.

- Requires monitoring and adjustment (delta-neutral approach).

- Risk: Sudden breakout can lead to losses.

2. Directional Trading (Trend Reversal or Continuation)

Traders use technical indicators (VWAP, RSI, Bollinger Bands) to predict intraday trend direction.

- Use price action near key levels (previous day’s high/low, VWAP).

- Bank Nifty is a popular index due to high intraday movement.

3. Scalping

High-frequency, low-margin trades using tight stop-losses.

- Suited for experienced traders.

- Quick entries/exits during volatile moves.

4. Gamma Scalping

Used by option writers to hedge positions during rapid moves.

- Complex, suitable for professionals or algo traders.

- Involves dynamic adjustment to maintain delta-neutral position.

🧠 Key Tips for Expiry Day Trading

- Avoid over-leverage. Expiry day volatility can wipe out capital quickly.

- Watch open interest. Sudden OI changes indicate potential reversals.

- Stay updated. Track news, RBI announcements, or global market cues.

- Start light. Volume increases around 1 PM–2 PM; plan accordingly.

- Use hedged positions. Naked selling can lead to unlimited losses.

❓FAQs on Expiry Day Trading Strategy

Q1: Is expiry day trading suitable for beginners?

Not recommended. The volatility and risk make it better suited for experienced traders with a strong understanding of options.

Q2: What time is best for trading on expiry day?

12 PM to 3 PM sees the most action, especially the last hour which is highly volatile due to position adjustments.

Q3: What tools or platforms are best for expiry trading?

TradingView, Zerodha Kite, Upstox Pro, or Angel One SmartStore offer fast execution and real-time charts.

Q4: Which index is best to trade on expiry day?

Bank Nifty is preferred for its volatility, while Nifty 50 is more stable.

Q5: What is the role of time decay on expiry?

Time decay (theta) accelerates on expiry day, especially after 1 PM. Option sellers can benefit significantly from this.

🏷️ Tags: Expiry Day Trading Strategy

#ExpiryDayTrading #OptionsTrading #IntradayStrategy #BankNifty #Nifty #ThetaDecay #Straddle #Strangle #StockMarketIndia #ExpiryStrategy #DayTradingTips

Also, read Best Liquid Stocks for Intraday Trading in India (2025)

Discover more from Trending News Fox

Subscribe to get the latest posts sent to your email.