HDFC Bank Q4 Results: FY25 Financial Highlights

Explore the latest HDFC Bank Q4 results, featuring comprehensive analysis and expert commentary on performance, profitability, and market outlook.

Trending News Fox, Digital Desk Team, Kolkata

Edited by Saibal Bose

HDFC Bank is India’s largest private sector lender. The bank reported its Q4 FY25 results on April 19, 2025. The results showcased solid financial performance and improved asset quality. (HDFC Bank Q4 Results: Net profit up 7% YoY at Rs … – Moneycontrol)

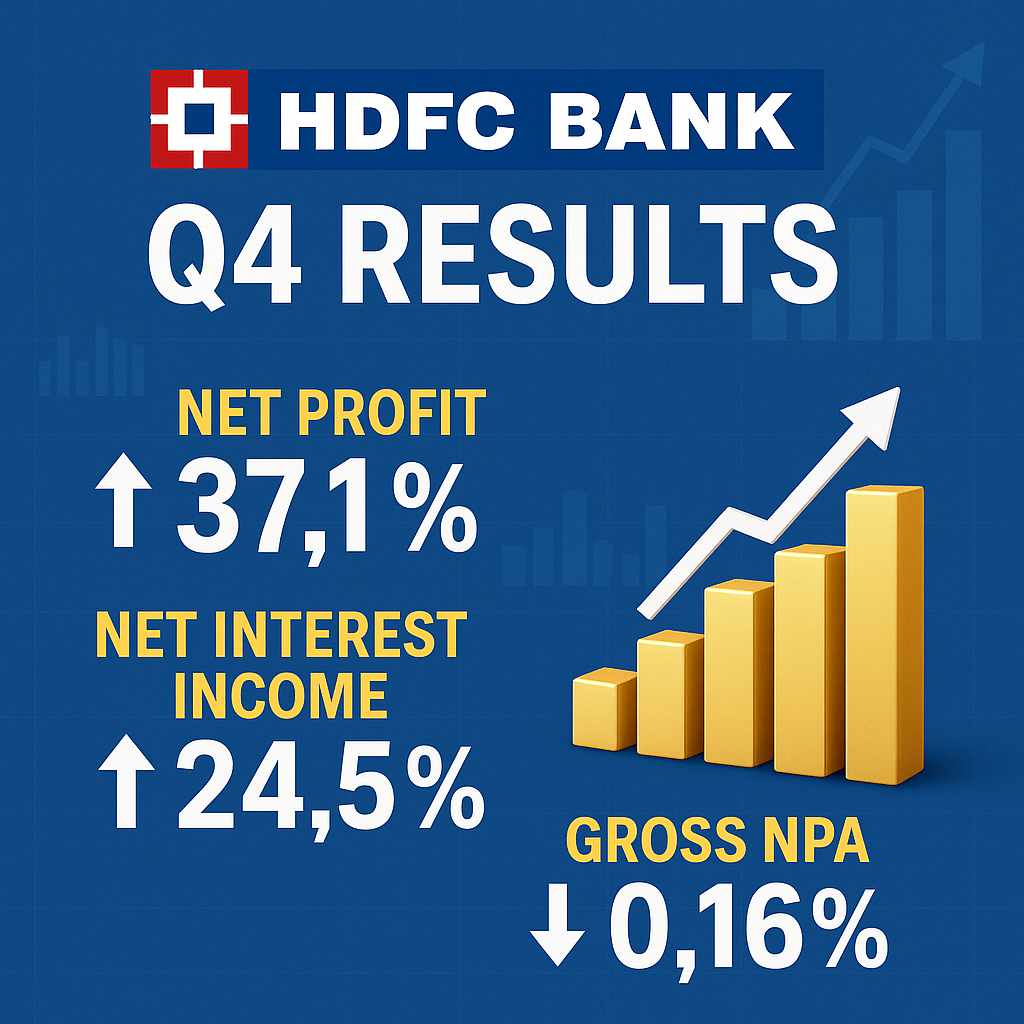

📊 HDFC Bank Q4 Results: FY25 Financial Highlights

- Net Profit: ₹17,616 crore, a 6.7% increase year-on-year (YoY), surpassing analyst expectations. (HDFC Bank Q4 Results Review: Analysts Positive As Credit Costs …)

- Net Interest Income (NII): ₹32,066 crore, up 10.3% YoY. (ICICI Bank, HDFC Bank, YES Bank report Q4 earnings; here are key …)

- Total Revenue: ₹1.2 lakh crore for the quarter. (HDFC Bank Q4 Results FY24-25: Revenue Rises to ₹1.2 Lakh Cr …)

- Earnings Per Share (EPS): ₹24.62 (basic). (HDFC Bank Q4 Results FY24-25: Revenue Rises to ₹1.2 Lakh Cr …)

- Dividend: ₹22 per share proposed. (HDFC Bank Q4 Results FY24-25: Revenue Rises to ₹1.2 Lakh Cr …)

💼 Operational Metrics

- Deposits: ₹27.15 trillion, a 5.9% increase quarter-on-quarter (QoQ). (India’s HDFC Bank says growth in quarterly deposits outpaces loans)

- Gross Advances: ₹26.44 trillion, up 4% QoQ. (India’s HDFC Bank says growth in quarterly deposits outpaces loans)

- CASA Deposits: 8.2% QoQ growth, indicating a healthy increase in low-cost deposits. (India’s HDFC Bank says growth in quarterly deposits outpaces loans)

🛡️ Asset Quality & Capital Adequacy

- Gross Non-Performing Assets (GNPA): 1.33%, improved from 1.42% in the prior quarter. (India’s HDFC Bank sees loan-to-deposit ratio at 85%-90% by FY27, CFO says)

- Net Non-Performing Assets (NNPA): 0.43%.

- Capital Adequacy Ratio: 19.55%, reflecting a strong capital position. (HDFC Bank Q4 Results FY24-25: Revenue Rises to ₹1.2 Lakh Cr …)

📈 Strategic Outlook

Post its merger with HDFC Ltd. in July 2023, HDFC Bank aims to normalize its loan-to-deposit ratio to 85%-90% by FY27, down from the current 96.5%. The bank expects loan growth to exceed the industry average. This growth is expected mainly in the retail segment. This is despite competitive pressures in corporate lending. (India’s HDFC Bank sees loan-to-deposit ratio at 85%-90% by FY27, CFO says)

🧠 FAQs

Q1: What was HDFC Bank’s net profit in Q4 FY25?

A1: ₹17,616 crore, marking a 6.7% YoY increase. (HDFC Bank Q4 Results Review: Analysts Positive As Credit Costs …)

Q2: How much dividend has HDFC Bank proposed?

A2: ₹22 per share. (HDFC Bank Q4 Results: Net profit up 7% YoY at Rs … – Moneycontrol)

Q3: What is the current Gross NPA ratio?

A3: 1.33%, down from 1.42% in the last quarter.

Q4: What are the total deposits and advances?

A4: Deposits at ₹27.15 trillion and gross advances at ₹26.44 trillion as of March 2025. (India’s HDFC Bank says growth in quarterly deposits outpaces loans)

Q5: What is the bank’s capital adequacy ratio?

A5: 19.55%. (HDFC Bank Q4 Results FY24-25: Revenue Rises to ₹1.2 Lakh Cr …)

🏷️ Tags

#HDFCBank #Q4FY25 #FinancialResults #NetProfit #Dividend #AssetQuality #BankingSector #IndiaFinance #HDFCMerger #RetailBanking

Discover more from Trending News Fox

Subscribe to get the latest posts sent to your email.